An endowment fund is a permanently invested pool of money where organizations use only the investment earnings—not the principal—to support ongoing operations, scholarships, programs, or specific purposes designated by donors. Unlike annual fundraising that addresses immediate needs, endowments create perpetual funding sources that sustain institutions across generations, providing financial stability independent of economic fluctuations or enrollment changes.

For schools, universities, and nonprofits, endowments represent the difference between surviving year-to-year budget cycles and confidently planning decades ahead. Endowment funds enable institutions to weather economic downturns, launch strategic initiatives without debt, offer competitive scholarships attracting exceptional students, and maintain program quality regardless of temporary revenue disruptions.

This comprehensive guide explains what endowment funds are, how they function, why organizations establish them, different endowment types serving various purposes, governance and management considerations, and how institutions recognize endowment donors whose contributions create lasting legacies supporting organizational missions far into the future.

Understanding Endowment Funds: Core Concepts and Structure

An endowment fund operates fundamentally differently from standard savings or operating accounts, following specific principles that distinguish endowment gifts from regular donations.

The Endowment Principal Preservation Principle

The defining characteristic of true endowments is the commitment to preserve the original donated principal permanently. When a donor contributes $100,000 to an endowment, that $100,000 remains invested indefinitely—the organization never spends the original gift amount.

Instead, the organization invests the principal to generate returns through dividends, interest, capital gains, and investment growth. Each year, the organization distributes only a portion of the investment earnings to support designated purposes while reinvesting some earnings to maintain the principal’s purchasing power against inflation.

This preservation principle transforms one-time gifts into permanent funding sources. A $100,000 endowment gift supporting scholarships doesn’t provide scholarships for just one year—it funds scholarships forever, potentially distributing $4,000-5,000 annually in perpetuity while the original $100,000 remains invested and grows over time.

How Investment Returns Support Operations

Understanding endowment spending rates clarifies how invested funds support organizational programs:

The Spending Rate Formula

Most endowments follow a spending policy distributing approximately 4-5% of the fund’s average value annually. This rate balances two competing objectives: providing meaningful current support for designated purposes and preserving long-term purchasing power against inflation.

If an endowment fund holds $1,000,000, a 4.5% spending rate distributes $45,000 that year to support scholarships, programs, or operations as specified by the endowment’s purpose. The remaining investment returns stay invested, helping the principal grow over time to maintain future spending capacity.

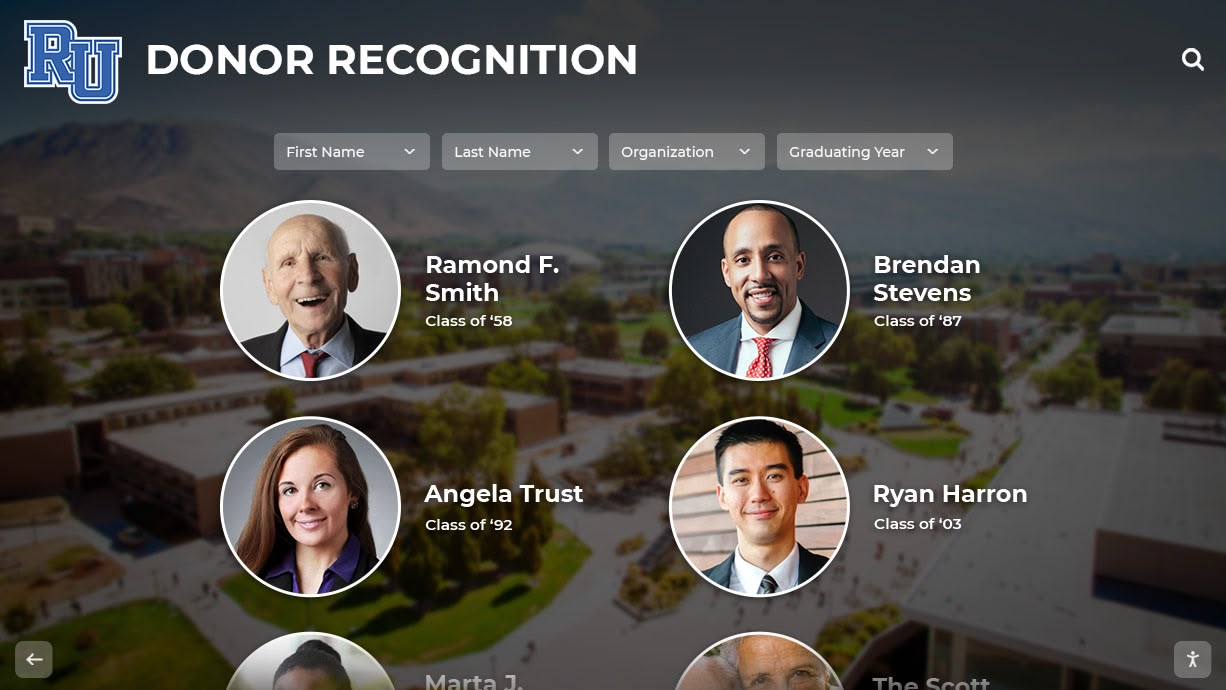

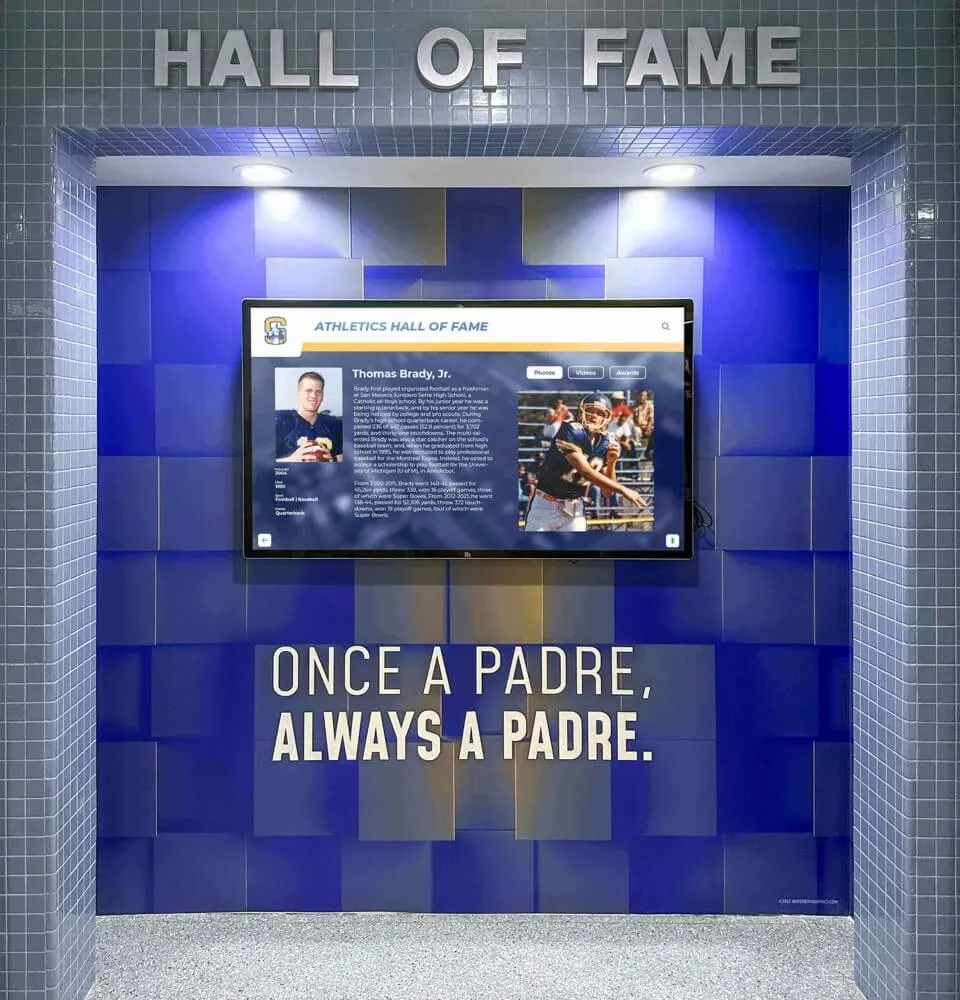

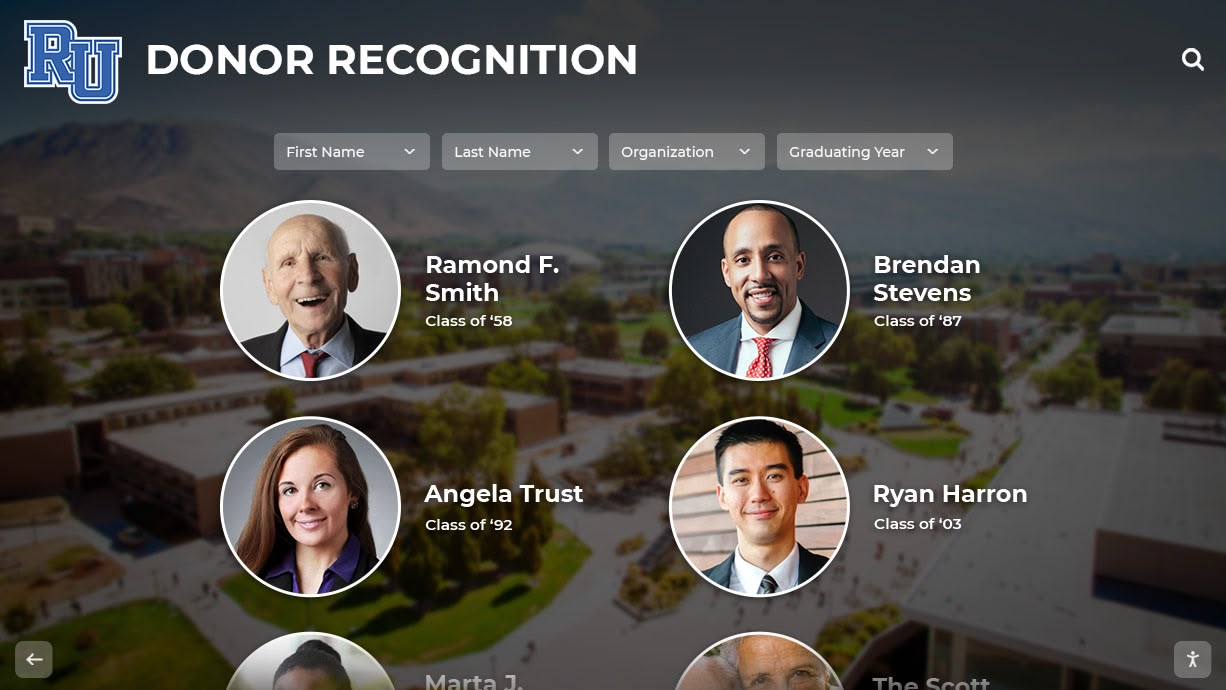

Universities honor endowment donors through permanent recognition displays celebrating contributions that support institutional missions across generations

Investment Return Assumptions

Endowment spending rates assume long-term investment returns averaging 7-8% annually across diversified portfolios. When endowments earn returns exceeding the spending rate, the excess reinvestment grows the principal, increasing future distributions. During years when returns fall below spending rates, endowments may distribute slightly more than earned, drawing minimal amounts from principal—acceptable occasionally but unsustainable long-term.

Professional endowment management balances these dynamics, adjusting spending policies, investment strategies, and distribution amounts to maintain perpetual support capacity.

Restricted vs. Unrestricted Endowments

Endowment funds fall into different categories based on donor restrictions and organizational flexibility:

Permanently Restricted Endowments

When donors establish endowments with specific permanent purposes—such as “The Johnson Family Scholarship for Engineering Students” or “The Smith Endowed Chair in Biology”—these restricted endowments must support only the designated purposes in perpetuity. Organizations cannot redirect these funds to other needs regardless of changing circumstances.

Restricted endowments ensure donor intent remains honored but reduce institutional flexibility if designated purposes become less relevant over time.

Temporarily Restricted Endowments

Some endowments include time-limited restrictions, such as supporting specific programs for defined periods before becoming unrestricted or converting to different purposes. These provide donor direction while acknowledging circumstances change.

Unrestricted Endowments

When donors contribute to general endowments without specific purpose restrictions, institutions may allocate earnings wherever needs are greatest—providing maximum flexibility to address evolving priorities, respond to unexpected opportunities, or support underfunded areas receiving less designated support.

Many institutions maintain balanced portfolios combining restricted endowments supporting specific priorities and unrestricted endowments providing operational flexibility.

Types of Endowment Funds: Supporting Different Institutional Needs

Organizations establish various endowment fund types serving distinct purposes within overall institutional strategy.

Scholarship and Financial Aid Endowments

The most common endowment type in educational institutions, scholarship endowments generate perpetual funding supporting student financial aid. Schools establish both general scholarship endowments supporting any students meeting basic criteria and named scholarship endowments honoring specific donors, family members, faculty, or alumni with defined eligibility requirements.

A $500,000 scholarship endowment distributing 4.5% annually provides approximately $22,500 each year—potentially covering full tuition for one student, partial support for several students, or supplementing institutional aid budgets. Over decades, this single endowment gift supports hundreds of students who might not otherwise afford education.

Scholarship endowments enable schools to compete for exceptional students by offering attractive financial aid packages independent of annual budget limitations. Institutions honor endowment donors through scholarship award ceremonies, recognition displays in school lobbies, and communications connecting donors with scholarship recipients.

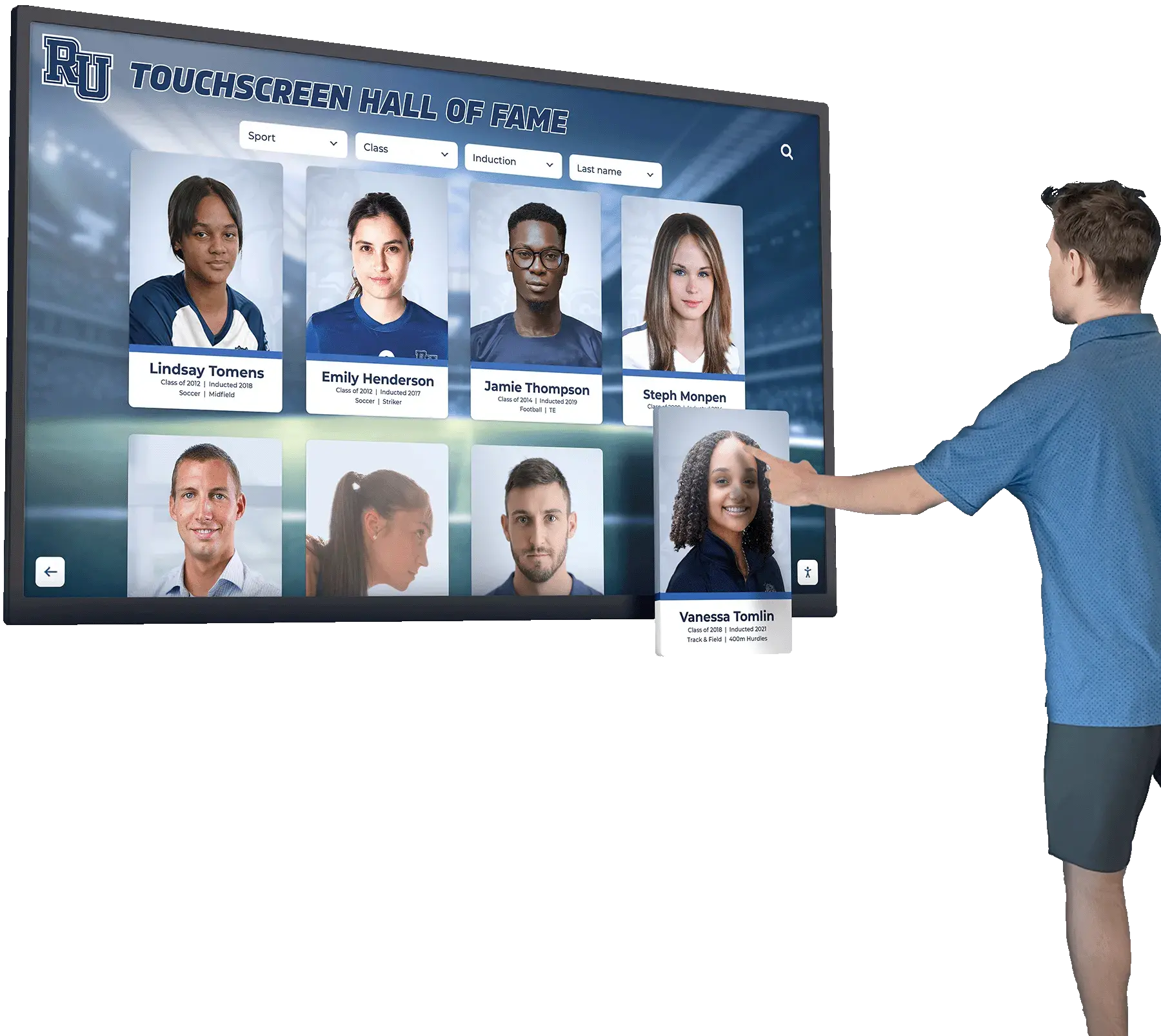

Modern digital recognition systems showcase endowment donors through interactive displays combining donor names, campus imagery, and giving society recognition

Endowed Positions and Faculty Chairs

Universities establish endowments funding specific faculty positions—typically requiring $1-3 million for endowed professorships or $3-5 million for endowed chairs. These endowments support competitive faculty salaries, research funding, professional development, and resources attracting distinguished scholars who enhance institutional reputation and program quality.

An endowed chair distributing $200,000 annually might cover a professor’s salary supplement, research assistants, laboratory equipment, conference travel, and publication costs—resources enabling cutting-edge research and exceptional teaching while honoring donors who believe in advancing knowledge within specific disciplines.

Endowed positions create permanent legacies connecting donors’ names with academic excellence, often commemorating family members, distinguished alumni, or individuals who valued education.

Program and Departmental Endowments

Organizations establish endowments supporting specific programs, departments, or initiatives requiring sustainable long-term funding. These might include athletic program endowments funding coaching positions and equipment, arts program endowments supporting performances and exhibitions, library endowments funding acquisitions and technology, research center endowments supporting ongoing investigations, or department endowments providing discretionary funding for chairs to address emerging needs.

Program endowments ensure critical initiatives receive reliable funding regardless of annual budget pressures, preventing valuable programs from facing elimination during financial constraints.

General Operating Endowments

Many organizations maintain unrestricted general endowments distributing earnings to support overall operations—providing budget flexibility, offsetting operating expenses, maintaining facilities, and funding strategic priorities as determined by leadership and boards.

General endowments function like institutional rainy-day funds that also provide sunny-day opportunities, stabilizing finances during revenue downturns while enabling investments in innovation during growth periods.

Strong general endowments indicate institutional health and resilience, demonstrating an organization can maintain quality and pursue opportunities without depending entirely on tuition, enrollment, or annual fundraising success.

Building Endowments: Fundraising Strategies and Donor Cultivation

Establishing meaningful endowments requires intentional fundraising strategies, significant donor cultivation, and clear communication about endowment impact.

Minimum Gift Thresholds and Naming Opportunities

Most institutions establish minimum contribution levels for creating named endowments—typical thresholds include:

- Scholarship endowments: $25,000-$100,000 minimum

- Program support endowments: $100,000-$500,000

- Endowed faculty positions: $1,000,000-$5,000,000

- Building or facility endowments: $5,000,000+

These minimums ensure endowments generate meaningful annual distributions supporting designated purposes. A $25,000 scholarship endowment distributing 4.5% provides approximately $1,125 annually—a worthwhile partial scholarship but insufficient to cover full tuition at most institutions.

Organizations often allow pooled endowments where multiple donors contribute to shared purposes until reaching functional funding levels, with recognition acknowledging all contributors.

Planned Giving and Bequest Endowments

Many endowments originate through planned giving—estate gifts, bequests, life insurance policies, retirement account designations, or charitable trusts maturing after donors’ lifetimes. Planned gifts enable donors to create substantial endowments impossible through current income, transforming accumulated wealth into lasting institutional support.

Schools cultivate planned giving through legacy societies recognizing individuals who include organizations in estate plans, educational programs explaining planned giving options, attorney and financial advisor partnerships facilitating gift structuring, and clear documentation honoring donor intent across leadership transitions.

Institutions honor planned giving commitments through recognition programs acknowledging intent before gifts mature, creating legacy donor communities that strengthen institutional culture around long-term thinking and intergenerational support.

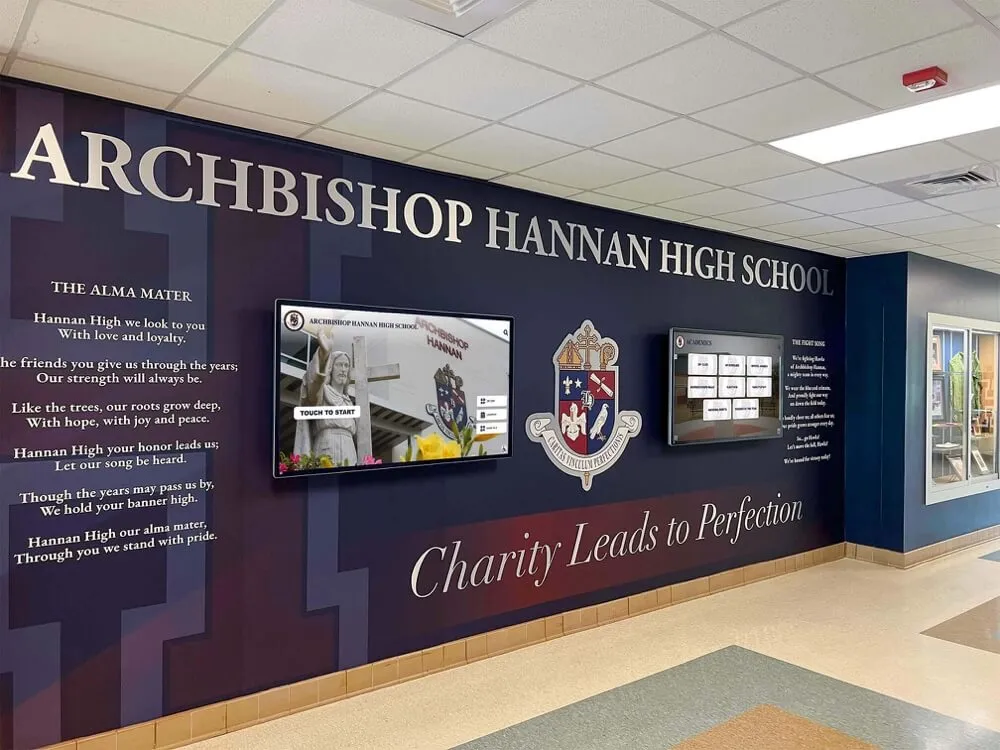

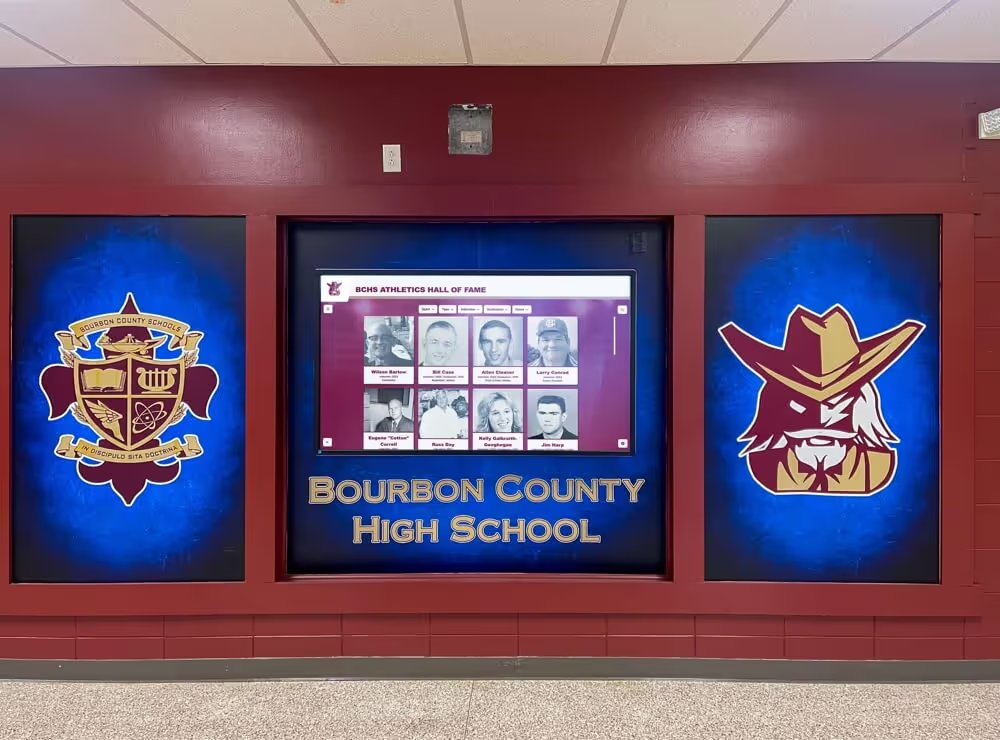

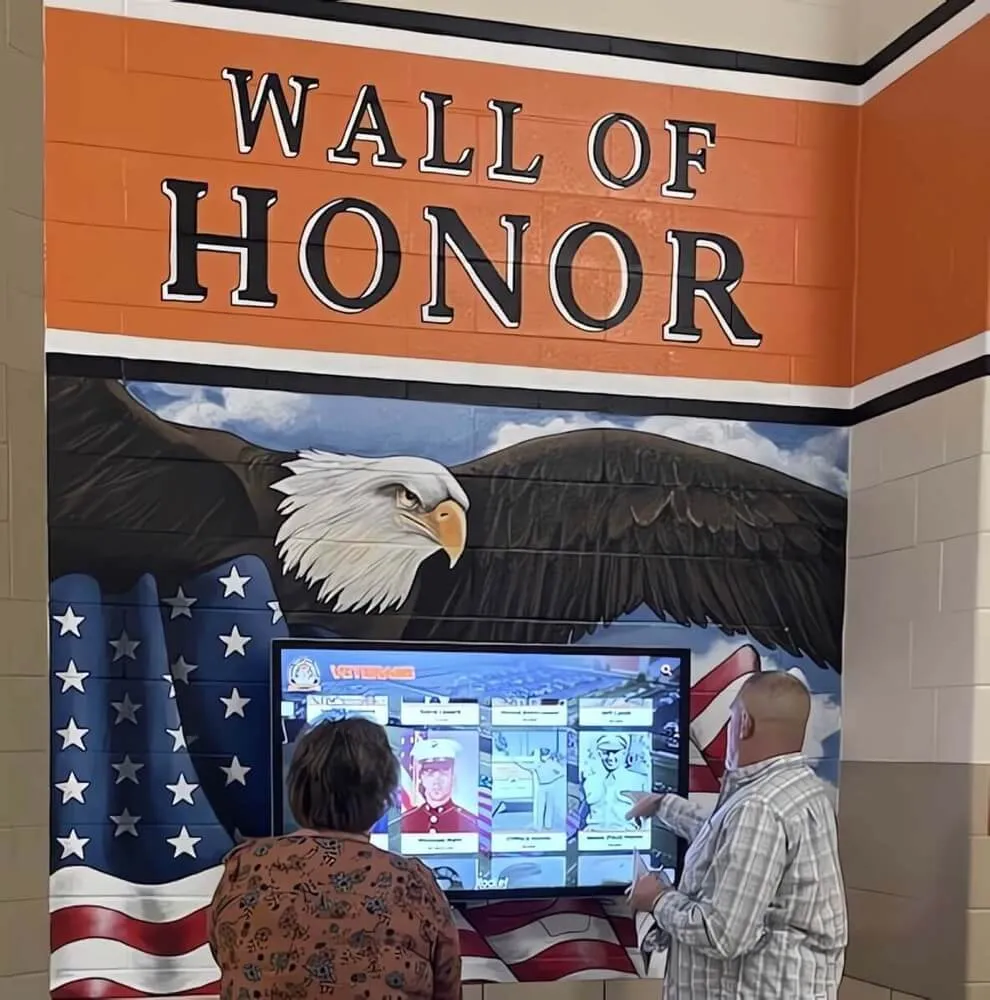

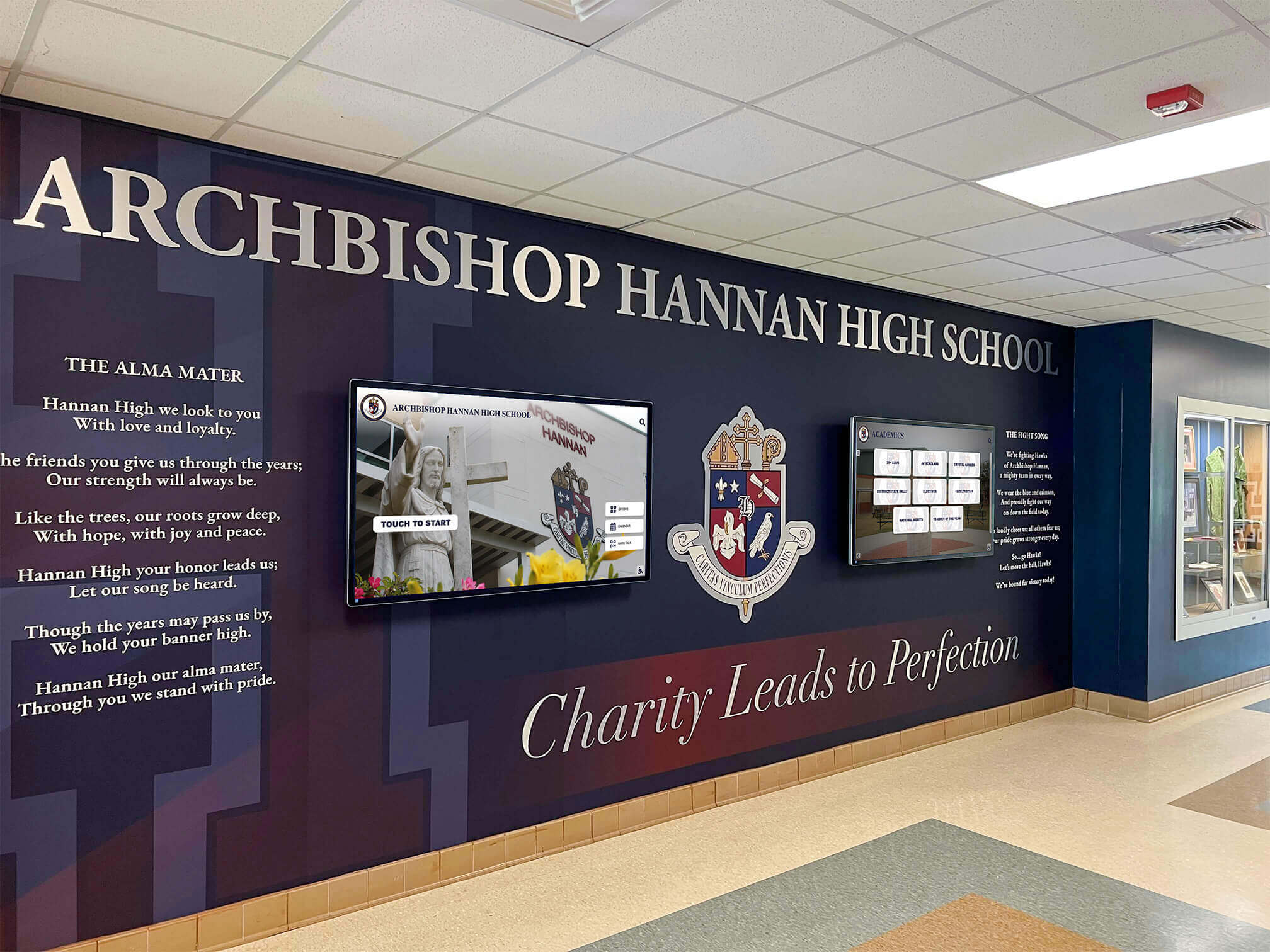

Educational institutions integrate donor recognition with achievement displays, connecting benefactor generosity to student and program success

Endowment Campaigns and Matching Programs

Organizations accelerate endowment growth through targeted capital campaigns establishing endowment building as priority fundraising goals. Campaign strategies include matching gift programs where leadership or major donors pledge to match new endowment contributions dollar-for-dollar—incentivizing donors by doubling gift impact.

“Challenge grants” operate similarly, with major donors contributing large gifts contingent on organizations raising matching amounts from broader donor bases. A $1,000,000 challenge grant might require raising $2,000,000 in new endowment contributions, ultimately creating $3,000,000 in new endowment funding.

These campaigns create urgency and momentum, encouraging donors to contribute while matching opportunities exist. Organizations recognize campaign donors through permanent donor walls and giving societies celebrating different contribution levels.

Endowment Governance and Management

Proper endowment stewardship requires strong governance, professional investment management, and transparency ensuring donor confidence in organizational responsibility.

Board Fiduciary Responsibilities

Institutional boards bear fiduciary responsibility for endowment stewardship, establishing investment policies, approving spending rates, monitoring fund performance, ensuring donor intent compliance, and maintaining intergenerational equity balancing current needs with future obligations.

Board investment committees typically oversee endowment management, working with professional investment advisors, establishing asset allocation strategies, reviewing performance against benchmarks, and adjusting policies as economic conditions change.

Strong governance prevents endowment mismanagement, inappropriate spending, or investment strategies misaligned with risk tolerance and time horizons.

Investment Management Approaches

Endowments typically employ diversified investment strategies across multiple asset classes:

Traditional Asset Allocation

Most endowments invest across stocks (domestic and international equities), bonds (government and corporate fixed income), real estate investment trusts, and cash equivalents. Traditional allocations might assign 60% to stocks for growth potential, 30% to bonds for stability and income, and 10% to alternative investments and cash.

Institutional Endowment Models

Larger endowments often employ more sophisticated strategies including private equity investments, hedge funds, commodities and natural resources, international real estate, and venture capital. These alternative investments potentially generate higher returns but require expertise, longer time horizons, and acceptance of reduced liquidity.

The “endowment model” pioneered by university endowments emphasizes long-term returns, diversification across uncorrelated asset classes, and willingness to accept illiquidity in exchange for return premiums.

Spending Policies and Distribution Rules

Endowment spending policies balance competing objectives: providing adequate current support, maintaining long-term purchasing power, and smoothing distributions to avoid volatile year-to-year changes disrupting program planning.

Rolling Average Methods

Many endowments calculate spending amounts based on rolling averages of fund values over 12-20 quarters rather than current quarter values. This smoothing mechanism prevents dramatic spending swings following market volatility, providing more predictable distributions for program planning.

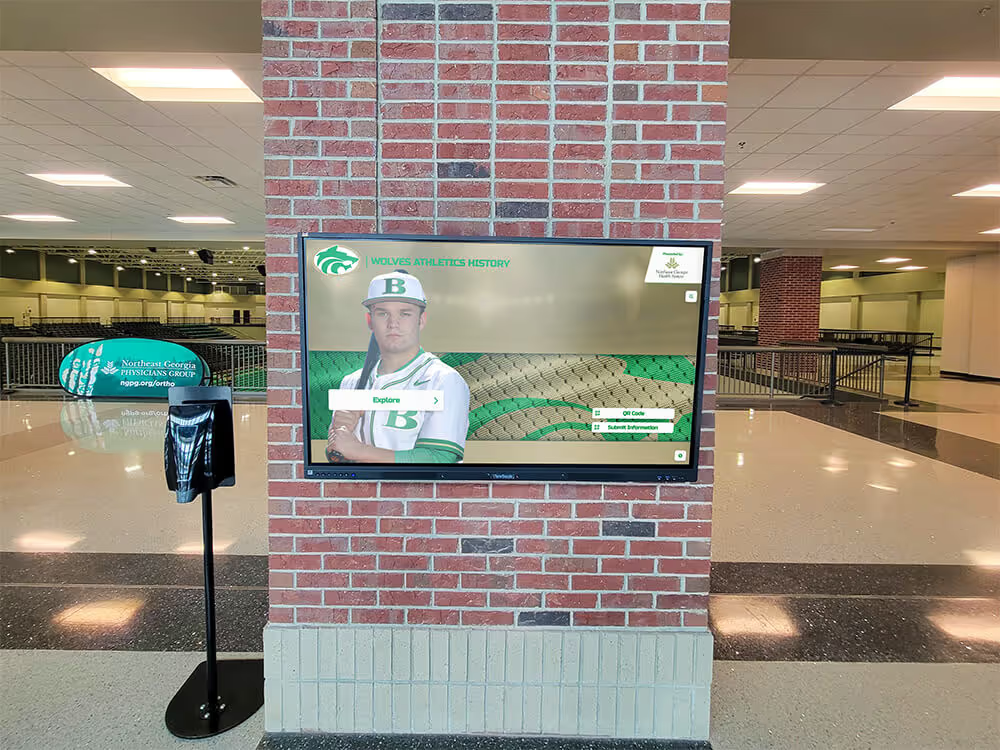

Interactive recognition technology enables institutions to showcase both achievement histories and donor contributions through engaging digital experiences

Inflation Adjustment Policies

Responsible endowments adjust spending amounts for inflation, ensuring distributions maintain purchasing power across decades. When inflation runs 3% annually, distributing flat dollar amounts year after year results in declining real support capacity—requiring policy adjustments maintaining inflation-adjusted distribution levels.

Sustainability Rules

During severe market downturns when endowment values decline substantially, some policies pause distributions temporarily or reduce rates below standard levels, allowing fund recovery rather than depleting principal. These sustainability provisions protect long-term viability during extraordinary circumstances.

Recognizing Endowment Donors: Creating Lasting Legacies

Organizations honor endowment donors through various recognition approaches celebrating contributions creating perpetual institutional support.

Physical Recognition Displays

Traditional endowment recognition includes named spaces on buildings, classrooms, and facilities honoring major donors, engraved plaques documenting scholarship establishment and donor names, dedicated spaces like reading rooms or gardens commemorating contributors, and recognition walls listing endowment donors by giving society levels.

These permanent installations create visible legacies connecting donors’ names with supported programs, inspiring subsequent generations to consider their own potential philanthropic impact.

Digital Recognition Solutions

Modern recognition increasingly incorporates interactive digital displays that showcase endowment impact through multimedia presentations, provide searchable databases helping visitors discover endowment histories and purposes, display updated information as endowments grow through additional contributions, and share stories connecting donors with scholarship recipients or program beneficiaries.

Solutions like Rocket Alumni Solutions enable institutions to create comprehensive donor recognition experiences combining traditional elements with interactive technology, maintaining current donor information without replacing physical plaques each time new contributions arrive.

Digital displays particularly serve institutions with growing endowments where static recognition reaches capacity limitations. Rather than removing early donors’ names to accommodate new contributors, digital systems expand indefinitely while maintaining historical recognition permanently.

Annual Stewardship and Impact Reporting

Beyond permanent recognition displays, organizations maintain ongoing donor relationships through annual endowment impact reports documenting investment performance and distributions, scholarship recipient profiles sharing student stories and achievements enabled by endowment support, program updates demonstrating how endowment funding advances organizational mission, and personalized communications from beneficiaries expressing gratitude to endowment donors.

These stewardship practices demonstrate responsible fund management, illustrate tangible impact, and strengthen donor satisfaction—increasing likelihood of additional contributions and inspiring planned giving to further grow endowments over time.

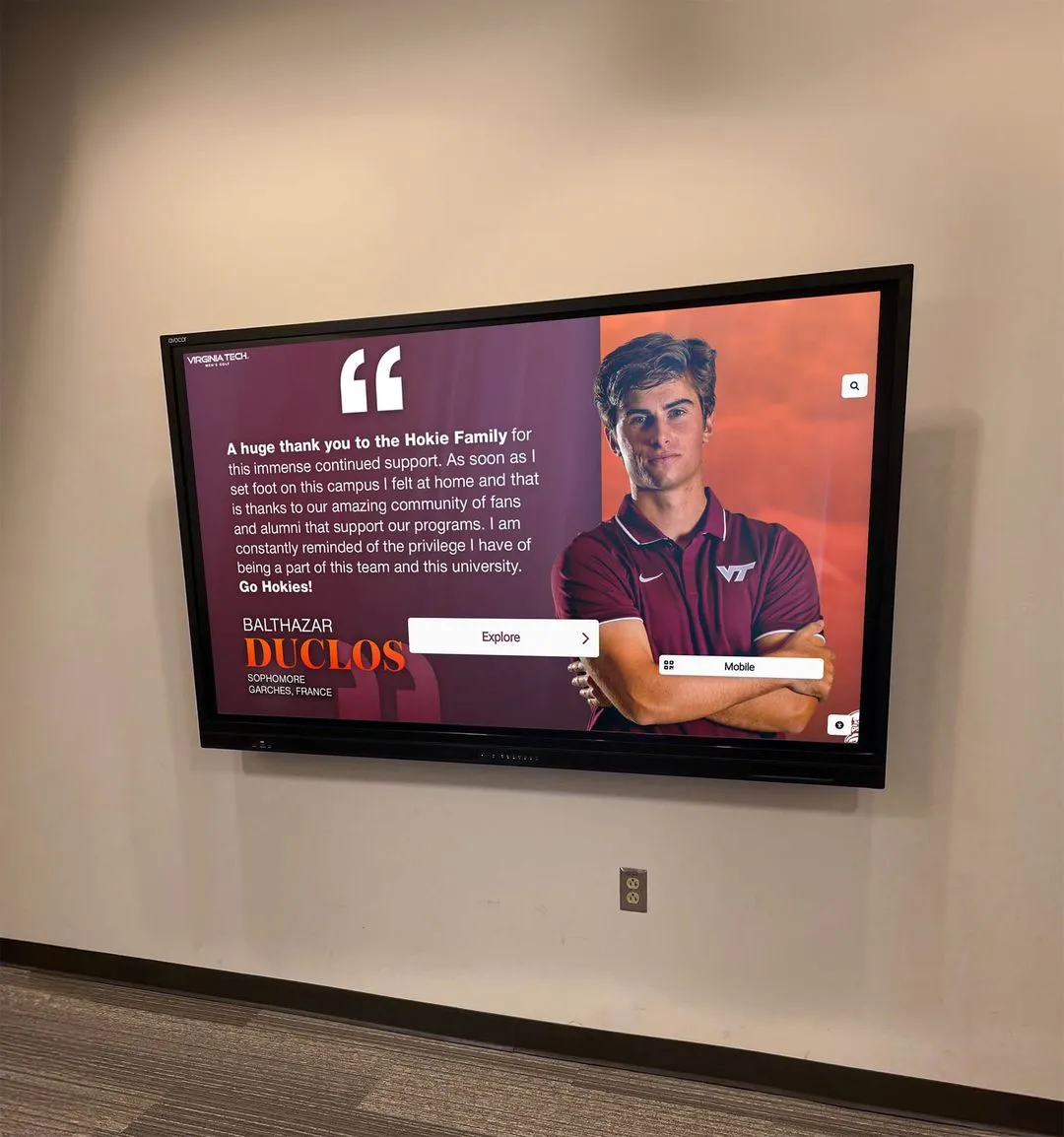

Effective recognition environments blend traditional architectural elements with modern digital displays, honoring heritage while embracing contemporary engagement tools

Endowment Benefits: Why Institutions Prioritize Permanent Funds

Understanding endowment advantages clarifies why organizations invest significant fundraising effort building permanent funding sources rather than focusing exclusively on annual giving.

Financial Stability and Institutional Resilience

Endowments provide financial ballast during economic downturns, enrollment declines, or unexpected challenges. When tuition revenue drops or annual giving decreases during recessions, endowment distributions continue supporting operations—preventing drastic program cuts, staff reductions, or facility closures that damage institutional quality and reputation.

Organizations with substantial endowments weathered the 2008 financial crisis and 2020 pandemic disruptions far better than institutions depending entirely on enrollment and annual revenue. While endowment values declined temporarily during market downturns, sustainable spending policies allowed continued distributions supporting essential operations.

Competitive Advantages in Mission Achievement

Strong endowments enable institutions to compete effectively for talent and execute missions at high levels. Universities with large endowments offer generous financial aid packages attracting exceptional students regardless of economic background, hire distinguished faculty through endowed positions offering competitive compensation, invest in cutting-edge facilities and technology through endowment earnings rather than debt, and maintain programs during temporary revenue challenges rather than eliminating valuable but expensive initiatives.

Schools with limited endowments face difficult choices between affordability, quality, and financial sustainability—often sacrificing one to maintain others. Institutions with substantial endowments avoid these tradeoffs, supporting excellence across multiple dimensions simultaneously.

Intergenerational Equity and Perpetual Mission Support

Endowments embody intergenerational thinking, ensuring current success doesn’t compromise future capacity. By preserving principal while spending only earnings, endowments enable organizations to serve not just today’s students but also students decades and centuries ahead—honoring mission commitments across generations.

This long-term perspective contrasts with annual fundraising supporting immediate needs. Both approaches matter, but endowments specifically address sustainability beyond current leadership, current students, and current circumstances.

Endowment Challenges and Considerations

Despite substantial benefits, endowments present management challenges organizations must address thoughtfully.

Balancing Current Needs with Future Growth

Organizations face ongoing tension between maximizing current endowment distributions supporting immediate programs and minimizing distributions to accelerate endowment growth through reinvestment. Spending too much today potentially shortchanges future generations; spending too little fails to maximize current mission impact for stakeholders served now.

This balance requires clear policies, transparent decision-making, and regular reassessment as circumstances change.

Managing Restricted Fund Limitations

As restricted endowments accumulate, organizations may find themselves constrained by donor restrictions that made sense historically but limit flexibility addressing evolving priorities. A university might hold large endowments supporting programs declining in relevance while struggling to fund growing programs lacking endowment support.

Some donor gift agreements include variance provisions allowing purpose modifications when circumstances change substantially, but many restrictions remain permanent—requiring organizations to either honor restrictions indefinitely or face complex legal processes seeking court approval for purpose changes.

Institutions address this challenge by encouraging unrestricted or broadly restricted endowment gifts providing flexibility, maintaining balanced portfolios across different purposes, and clearly communicating to donors how restriction specificity impacts long-term usefulness.

Investment Risk and Market Volatility

Endowments generate returns by accepting investment risk, creating exposure to market volatility. During severe downturns like 2008, major endowments declined 20-30% in single years—temporarily reducing distributions just when institutions faced increased pressure from enrollment challenges and reduced annual giving.

Professional investment management mitigates this risk through diversification, appropriate asset allocation matching risk tolerance, and spending policies smoothing distribution volatility. However, market risk remains inherent in endowment investing—organizations must accept short-term volatility in pursuit of long-term growth necessary for sustainable distributions.

Modern institutional spaces integrate multiple recognition approaches, combining architectural design, traditional graphics, and [interactive digital displays](https://toucharchives.org/blog/interactive-touchscreens-museums-galleries/?utm_source=organic&utm_medium=seo-auto&utm_content=digitalyearbook&utm_campaign=what-is-an-endowment-fund&utm_term=seo) creating engaging donor recognition environments

Starting and Growing Endowments: Practical Implementation

Organizations beginning endowment development or seeking to accelerate endowment growth implement structured approaches addressing fundraising, governance, and stewardship.

Establishing Endowment Policies

Before soliciting endowment gifts, organizations develop clear policies governing:

Gift Acceptance Guidelines

Minimum gift levels for named endowments, acceptable gift types (cash, securities, real estate, planned gifts), processes for negotiating donor agreements and restrictions, and approval authorities for accepting various gift sizes and types.

Investment Policy Statements

Asset allocation targets and ranges, risk tolerance and return objectives, spending rate formulas and adjustment mechanisms, rebalancing procedures, and performance benchmarks for evaluation.

Spending and Distribution Rules

Calculation methods for annual distributions, timing of distributions to departments and programs, procedures for handling restricted vs. unrestricted funds, and policies for endowments temporarily below minimum funding levels.

Clear policies establish frameworks enabling efficient gift acceptance and professional fund management while protecting institutional interests and honoring donor intent appropriately.

Cultivating Major Gift Prospects

Endowment fundraising focuses primarily on major gift prospects capable of significant contributions—requiring intensive relationship-building:

Organizations identify prospects through wealth screening identifying capacity for major gifts, engagement analysis highlighting committed supporters, and planned giving indicators suggesting estate gift interest. Cultivation involves personalized communications demonstrating impact, exclusive events connecting prospects with leadership and beneficiaries, campus visits showcasing programs and recognition opportunities, and customized proposals matching institutional needs with donor interests and capacity.

Successful endowment fundraising emphasizes patience—major gift decisions often require years of relationship-building before commitments materialize.

Communicating Endowment Impact

Organizations strengthen endowment support through clear impact communication demonstrating responsible stewardship:

Annual reports document endowment performance, spending distributions, and supported programs. Beneficiary testimonials share scholarship recipient stories, faculty research enabled by endowed positions, and program outcomes made possible through endowment funding. Financial transparency details investment returns, spending rates, and fund balances demonstrating professional management. Recognition events celebrate endowment donors, introduce scholarship recipients, and showcase program achievements.

These communications build donor confidence in organizational stewardship, increase satisfaction with philanthropic investments, and inspire continued support growing endowments over time.

Endowments vs. Annual Giving: Complementary Fundraising Approaches

Organizations maintain balanced advancement programs combining endowment development with annual fundraising—each serving distinct purposes within comprehensive resource development strategies.

Annual Giving Supports Immediate Operations

Annual giving campaigns solicit renewable contributions supporting current-year operations, program enhancements, and immediate priorities. These campaigns typically target broad donor bases through direct mail, online giving platforms, phonathons, and giving days—emphasizing accessibility and participation across all capacity levels.

Annual giving provides flexible funding addressing evolving needs, responds quickly to unexpected opportunities or challenges, and maintains broad donor engagement building relationships potentially leading to major gifts later.

Endowment Gifts Create Permanent Infrastructure

Endowment fundraising targets major gift prospects, emphasizes lasting impact transcending current needs, requires longer cultivation periods, and focuses on creating permanent funding infrastructure supporting institutional sustainability.

Many organizations view annual giving as “pay-as-you-go” support covering current expenses while endowments represent “savings” ensuring long-term viability—both essential for healthy institutions.

Integrated Advancement Strategies

Effective advancement programs integrate both approaches: annual giving campaigns identify engaged supporters who may become major gift prospects, endowment stewardship maintains donor relationships encouraging continued annual support, and planned giving programs combine current annual contributions with future estate gifts growing endowments.

Organizations communicate clearly about different gift purposes, helping donors understand how various contribution types support institutional missions differently while respecting donor preferences regarding designation and timing.

Modern Donor Recognition: Celebrating Endowment Legacies

As endowment fundraising evolves, recognition approaches increasingly incorporate technology enhancing traditional methods while creating engaging experiences inspiring future philanthropy.

Interactive Recognition Displays

Digital recognition systems enable dynamic donor celebrations through interactive touchscreen displays featuring searchable donor databases, endowment history timelines, multimedia presentations connecting donors with program impact, and regular content updates maintaining current information without physical modifications.

These systems particularly benefit institutions where endowments grow continuously—traditional plaques reach capacity limitations requiring expensive replacements or additions, while digital systems expand indefinitely through software updates.

Organizations implementing interactive donor walls report enhanced engagement, increased donor satisfaction with recognition experiences, and improved stewardship outcomes as technology enables richer storytelling about philanthropic impact.

Combining Traditional and Digital Recognition

Many institutions adopt hybrid approaches integrating permanent architectural elements like named spaces and engraved plaques with adjacent digital displays providing detailed information, regular updates, and interactive exploration.

This combination honors traditional recognition aesthetics while embracing contemporary engagement tools—respecting donor preferences for permanent physical recognition while adding digital enhancements that deepen understanding and appreciation of philanthropic legacies.

Virtual Recognition and Online Engagement

Organizations extend recognition beyond physical campus spaces through online donor recognition galleries, virtual tours highlighting named spaces and endowment impacts, social media campaigns celebrating donors and sharing beneficiary stories, and digital yearbooks documenting institutional history including major philanthropic milestones.

Virtual recognition particularly matters for geographically dispersed donor communities including distant alumni who rarely visit campus but remain deeply connected to institutional missions—creating recognition experiences accessible anywhere rather than requiring physical presence.

Conclusion: Endowments as Institutional Foundations

Endowment funds represent among the most important financial structures organizations establish—transforming one-time gifts into perpetual support sustaining missions across generations, providing financial stability enabling confident long-term planning, and honoring donors who believe deeply in institutional purposes beyond their own lifetimes.

For schools, universities, and nonprofits, endowment development requires patience, professional stewardship, and clear communication about long-term vision. However, organizations that successfully build substantial endowments create competitive advantages supporting excellence, weathering challenges, and pursuing opportunities that institutions lacking permanent funding sources cannot access.

Whether you’re beginning endowment development at a growing organization or seeking to accelerate endowment growth at an established institution, focus on clear policies governing gift acceptance and fund management, professional investment stewardship protecting donor gifts while generating sustainable returns, transparent communication demonstrating impact and building donor confidence, appropriate recognition honoring contributions and inspiring future support, and integration of endowment priorities within comprehensive advancement strategies.

The donors who establish endowments deserve recognition celebrating their extraordinary generosity and vision. Modern recognition solutions that combine traditional permanent displays with interactive digital technology create engaging experiences honoring philanthropic legacies while inspiring others to consider their own potential for lasting impact supporting causes they value deeply.

Ready to enhance your donor recognition program with modern digital displays celebrating endowment contributors? Explore how Rocket Alumni Solutions creates engaging recognition experiences that honor philanthropic legacies while inspiring continued support building institutional capacity for generations ahead.